MAWISTA

Student Pro

NEW: Private full health insurance for international academics (Bachelors, Masters)

MAWISTA

Student Pro

from €42.67 per month

High-quality health insurance for international academics in Germany:

- Students (Bachelors, Masters)

- Preparatory course students

MAWISTA Student Pro

from €42.67 per month

- Private full health insurance

- Large scope of benefits

- No age limit

- 12 weeks protection in home country

Your stay in Germany

Welcome to MAWISTA Student Pro

For international students, being successful in your studies starts with having the right health insurance. MAWISTA Student Pro is a high-quality private full health insurance that is specially tailored to the needs of international students at German universities (Bachelors, Masters). The MAWISTA Student Pro tariff is recognised by all immigration authorities and universities.

MAWISTA Student Pro covers medical costs in the case of illness or an accident. You can visit any recognised doctor or simply get medical advice via video call in over 20 languages. Naturopathy provided by doctors is also included in the tariff.

Within the MAWISTA Student Classic and Pro tariffs, you can freely choose whether you want to insure dental coverage and which deductible is your favorite.

MAWISTA Student Pro can be applied for either before or during your studies in Germany. The health insurance plan is valid for up to 5 years for studying in Germany. The tariff can be cancelled on a monthly basis, thus providing academics with a high degree of flexibility.

The health insurance plan also offers lots of flexibility outside Germany. When traveling to other EU countries, the Student Pro tariff provides unlimited insurance coverage. Worldwide, the tariff covers up to 4 weeks and even up to 12 weeks during a stay in the home country. If you then start your career while here, you can stay insured on a private health insurance tariff for an affordable price.

Note: If you need a visa to travel to Germany, we recommend taking out the MAWISTA Visum plan and switching to the MAWISTA Student Pro tariff once you are in Germany.

Mawista Student Pro

Tariffs at a glance

Insurance period

From 1-60 months

(5 years)

Age limit

insurable from

18 to 70 years

Flexibility Dental

coverage optional / deductible choosable

Payment method

Monthly/annually via

SEPA direct debit

Cancellation

In writing, 15 days

before the end of the relevant month

Excess

10% up to max. €500

or max. €1.200

Insured region

Germany, EU and home country

Digital services

Video calls with doctors in over 20 languages

Proof of insurance

Recognised by authorities and universities

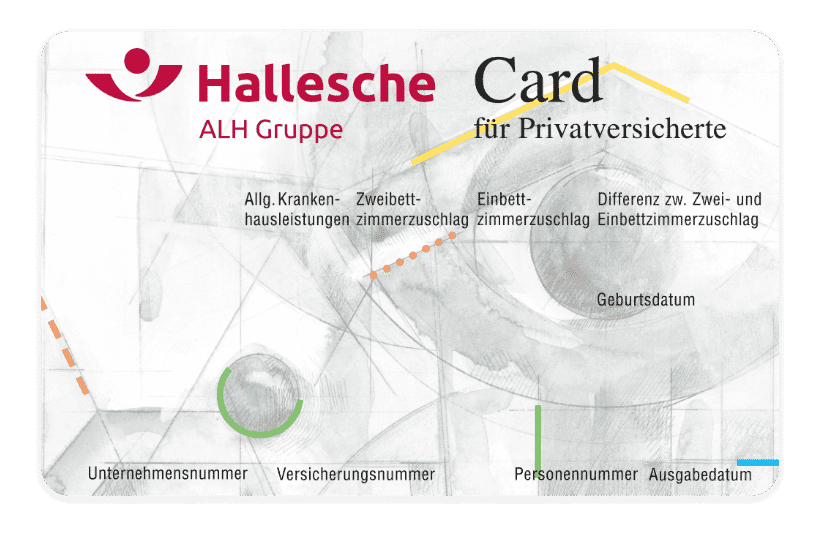

Discover your insurance card

The insurance card is included free of charge with all Student Pro tariffs.

Medical consultation

Video consultations

Process

- You can easily set up an appointment that suits you using the Hallesche online form. And you can also use this to tell us about what your concerns are. This ensures that you will get to speak to the right specialist.

- As soon as we have reserved an appointment for your video call, you’ll receive a confirmation via email with a link to start your Hallesche video consultation.

- Once your doctor has joined the conversation, a window will open. Please accept the call and you’ll then see your doctor on the screen.

- Take your time with your questions – there is no time limit on the video consultation.

Benefits

-

Medical care

Video consultation with doctors and 24-hour health hotline in over 20 languages. -

Conveniently from home

You’ll get medical advice in the comfort of your own home. -

Saves time

There are no travel or waiting times. -

Diagnosis and tailored advice

You and the doctor can see each other – for many medical issues, this enables a more precise diagnosis -

No financial disadvantages

The video consultation has no impact on your premium reimbursement or excess -

Prescriptions

Private prescriptions can be issued and sent to cooperating pharmacies or your preferred pharmacy.

Finance and insurance manager

Customer portal & app

We offer the popular Hallesche4u app:

- Easy submission of invoices and receipts thanks to the photo and upload function

- All contracts and payment notifications at a glance

- Various services e.g. change of address in just a few clicks

- If you have any questions, you can contact the insurer directly via the app

Decision-making tool

A comparison of tariffs

MAWISTA Student Pro Classic

MAWISTA Student Pro Premium

General

Outpatient treatment by a physician

Inpatient treatment in a hospital incl. operations

Medicines and dressings

Natural remedies for treatments carried out by doctors

Video consultations

Customer portal & app

Private doctor in hospital (up to maximum rates determined by the fee schedule)

Stays in hospital

Multi-bed room

Individual room

Multi-bed room

€750

€1,500

Maximum amount for naturopathic medicine for treatments by alternative practitioners, osteopaths, etc.

€500

Maximum amount for visual aids every 2 years

€250

Maximum amount for digital health services per year

€60

€120

Outpatient psychotherapy sessions per year

25

Deductible per calendar year

€1,200 or

10% up to max. €500

€1,200 or

10% up to max. €500

Teeth (optional)

Deductible (max. €500 / year, no deductible for teeth)

10 %

10 %

Dental treatment

Dentures/inlays

Orthodontics following an accident

up to 18 years of age

Maximum amount of prophylaxis in one calendar year

€100

(for foreigners in Germany)

3,5

3,5

Health insurance coverage in home country

3 months

3 months

Health insurance coverage in Germany incl. holidays in the EU/Switzerland

60 months

60 months

Monthly contributions

1-60 months

From € 42.67

From € 86.14

Our service

Thanks to our quick, expert service, you will receive your contract documents within 24 hours after verification. We know that students need to be flexible, which is why you can pay your premiums monthly and cancel the tariff on a monthly basis.

The insurer

Hallesche Krankenversicherung a. G.

Reinsburgstraße 10

70178 Stuttgart

Frequently asked questions

Questions about the tariff

Tariff

Illness

Bill

Benefit

Application

MAWISTA Student Pro insurance is valid in Germany for up to five years.

The health insurance plan provides coverage within the EU and Switzerland for up to four weeks.

In your home country, coverage is provided for up to 12 weeks.

The premium can be paid in monthly rates with a due date on the first of each month. Alternatively, payment of the entire annual premium is possible at the beginning of each insurance year.

The Student Pro insurance tariff ends after a term of 5 years at the latest. You can then opt for a follow-up tariff from Halleschen without a new health check.

The contract can be terminated at the end of any month. To do so, the cancellation must be made via the Hallesche4u app or alternatively by email and must be received by the insurer at least 15 days before the end of the month.

You can access the Hallesche4u app via the following two links. Please note that you need your policy number to register in the app. You will find it in your contract documents.

- iOS (https://apps.apple.com/de/app/hallesche4u/id1489935449?ls=1)

- Android (https://play.google.com/store/apps/details?id=de.hallesche4u.app)

Or

You can send your cancellation by e-mail to the following address: service@hallesche.de. Please make sure that your cancellation letter contains the following data:

- Your name

- Your policy number

- Your contracted tariff

- The date on which the cancellation should take effect

- If you continue your stay in Germany after cancelling Student Pro, please also submit a proof of your subsequent insurance.

You can reduce the deductible to max. 500 EUR, which means you pay 10% per insured medical event yourself up to a maximum amount of 500 EUR per calendar year.

Example:

Without this upgrade, you would pay the insured medical costs up to a maximum amount of 1,200 EUR per calendar year yourself. If your insured benefits exceed in total 1.200 EUR, the insurer will pay 100% of the insured benefits thereafter. I.e., your medical bill(s) is 2.000 EUR. You pay 1,200 EUR, the insurance company pays 800 EUR.

In case of a relative deductible of 10% per insured service and a maximum amount of 500 EUR per calendar year, you contribute 10% of the cost of all your insured services. The upper limit for your contribution to the costs is 500 EUR per calendar year.

I.e., your medical bill is 2.000 EUR, you would pay 200 EUR (10%) and the insurance company would pay 1.800 EUR.

If the medical costs in the calendar year should increase to 10.000 EUR, then you would only pay max. 500 EUR and the insurance company would cover the outstanding amount of 9.500 EUR.

Long-term care insurance covers the risk of long-term care. This means that in case of an insured event of a need for care, cash benefits or non-cash benefits are provided. Since 1995, every person residing in Germany (in a statutory or private comprehensive health insurance) has been obliged to insure his or her own nursing care risk (at the latest 1 year after entry) and to take out a corresponding insurance policy.

If the illness is minor (for example, you have the flu, headaches or have had a minor accident), we recommend visiting a general practitioner in your local area. The doctor providing treatment can refer you to a specialist if needed. If you have toothache, you should go straight to a dentist.

If you have severe pain, a serious accident or need to see someone outside of normal opening hours (for example at the weekend), you should go to a hospital or visit an on-call doctor’s practice that offers an emergency service. If you need to stay in hospital as an inpatient (e.g. for an operation), you must contact your insurer immediately. In this case, the emergency call centre team will clarify the details of how the costs will be covered directly with the hospital. The advantage of this is that there are no upfront payments for high hospital invoices as the insurer will pay your costs directly in this case.

You have the option to select a cooperating pharmacy at apotheken.de. Your prescription will be sent to the pharmacy of your choice after the video consultation. At the same time, you will receive a pick-up code by e-mail, which you can use to pick up the corresponding products at the pharmacy.

Alternatively, the prescription can be sent to you by post. It is not possible to send the prescription by e-mail.

Variant 1: An absolute deductible of 1,200 euros per calendar year: Here, you as the policyholder pay the costs of claims up to a maximum amount of 1,200 euros per calendar year yourself. If your insured benefits exceed this amount, the insurer pays the difference in costs. Example: The insured person suffers an accident. The hospital bill amounts to 24,000 euros. The insured person pays 1,200 euros of the bill himself. The insurer covers the outstanding difference of 22,800 euros.

Option 2: A relative deductible of 10% per insured service and a maximum of 500 euros per calendar year. Here, you as the policyholder pay 10% of the costs of all insured services. The upper limit for your cost sharing is 500 euros per calendar year. Example: The insured person receives a first medical bill in the amount of 100 euros. He/she must pay 10% of this amount, i.e. 10 euros. The second medical bill is 5,000 euros. 10% of the second medical bill is 500 euros. Since the policyholder has already paid 10 euros himself in the course of the first medical bill, he only has to pay 490 euros of the second medical bill himself. This is the maximum amount that the policyholder has to pay per calendar year. All other costs for insured services in this calendar year are borne by the insurer.

More information about the deductible can be found here.

To help you obtain a residence permit from the immigration authorities, we would be happy to issue special certificates proving your private health insurance coverage on request.

The conditions of insurance described in section 5 outline the cases where there is no or limited insurance cover:

(1) When will the insurer not pay out?

The insurer will not pay out in the following cases:

- For illnesses and accidents intentionally caused by the insured person and their consequences.

- Accommodation which is necessary due to the need for nursing care or custody.

- Treatment by spouses, life partners, parents or children. Proven material expenses will be reimbursed by the insurer in accordance with the tariff.

- For bills from persons or from hospitals which the insurer has excluded from reimbursement for important reasons. This applies only if the insurer has notified the insured person of this before the insured event. Otherwise, the Insurer will continue to pay for 3 months from the date on which it notified the insured person.

(2) Does the insurer pay for withdrawal treatment costs?

The insurer does not pay for inpatient and outpatient withdrawal treatment unless this benefit is expressly included in the tariff.

(3) Does the insurer pay benefits in the case of war, civil unrest and terror?

The insurer does not pay if the insured person is injured due to acts of war in Germany.

The insurer also does not pay if the insured person is injured outside Germany because they have actively taken part in civil unrest.

The insurer also does not pay if the insured person is injured outside Germany due to acts of war or terror attacks. However, the insurer will pay if

- The German Foreign Office has not warned about travel to the destination or

- only issues a warning for the destination once the insured person is already there and

- they leave the area immediately or

are prevented from leaving the area through no fault of their own. This could occur if e.g. the insured person’s life is threatened if they leave the area.

(4) Does the insurer pay in the case of a pandemic?

The insurer will pay if the insured person is treated as the result of a pandemic in Germany.

The insurer does not pay if the insured person is treated outside Germany as the result of a pandemic. However, the insurer will pay if

- The German Foreign Office has not warned about travel to the destination or

- only issues a warning for the destination once the insured person is already there and they cannot leave the area due to travel restrictions

(5) Does the insurer pay for spa or sanatorium treatments?

The insurer only pays for spa or sanatorium treatments if this is expressly included in the tariff.

(6) Does the insurer pay for rehabilitation treatment?

The insurer does not pay for rehabilitation treatment. If the treatment is a follow-up treatment, the insurer will pay in accordance with section 5, para. 7.

(7) Does the insurer pay for follow-up treatments?

The insurer will pay for medically necessary inpatient or outpatient follow-up treatments, provided it has previously agreed to this in writing.

However, the insured person does not require written agreement for the first 3 weeks of a follow-up treatment if the following conditions are met:

- The treatment starts within 28 days of a stay in hospital and

the treatment is carried out in a facility that has been recognised by a statutory rehabilitation provider for this treatment.

If the insured person cannot start the follow-up treatment within 28 days for medical reasons, they will require the agreement of the insurer. The insurer will grant permission provided this later follow-up treatment is medically necessary. This may, for example, be the case following radiotherapy for treatment of a tumour or if a suitable facility is not available in good time.

The insured person can apply to us for an extension of the follow-up treatment. The insurer will approve this provided it is medically necessary.

If the insured person can claim follow-up treatment from a statutory rehabilitation provider following acute inpatient treatment, they must claim these statutory benefits in the first instance. The insurer will then deduct the benefits offered by the statutory rehabilitation provider from the reimbursement.

There are cases in which the insured person could receive statutory rehabilitation treatment, but culpably does not do so. In this case, the insurer deducts the benefit that the statutory provider would have provided had it been claimed from the reimbursement.

(8) In which cases can the insurer reduce the benefit to a reasonable amount?

If a treatment or other measure for which benefits have been agreed exceed what is medically necessary, the insurer may reduce the benefits to a reasonable amount. If the costs for treatment or other benefits are conspicuously out of proportion with the benefits provided, the insurer does not have to provide such benefits.

(9) What happens when several payers are involved?

If the insured person can claim from another cost bearer, they must do so to the full extent possible first of all. The insurer will deduct these benefits from the reimbursement. If the insured person has claims against more than one payer as the result of the same insurance event, they will not receive more than the actual costs incurred as a total benefit.

You can go to the doctor even before you have the insurance card. The only condition is that your insurance coverage has already started. At the doctor’s office, you have to provide your contact details and insurance number. After that you will get a bill which you must submit to the insurer.

The MAWISTA Student Pro Classic tariff covers 100% of the statutory preventive programs up to the age of 18. The MAWISTA Student Pro Premium tariff covers 100% of the statutory preventive programs without age limit.

No, the Student Pro tariffs do not include any waiting periods.

You can access the Hallesche4u app via the following two links. Please note that you need your policy number to register in the app. You will find it in your contract documents.

Invoices can be sent by email to the following address: service@hallesche.de. Please note the following:

- Include your insurance number and the keyword “invoice submission” in the subject line, if available.

- Scan your invoices and prescriptions individually (1 receipt per page) and make sure the scan quality is good (min. 200 dpi).

- Use only the following file formats: PDF, JPG & PNG

- The total size of the e-mail must not exceed 30 MB

- Note: Please do not send links to cloud documents or password protected attachments

If the costs are incurred in a foreign currency, we will convert them into euros. We use the current exchange rates for the day on which we receive the receipts. The exchange rate is the official euro exchange rate of the European Central Bank or the exchange rate of the Deutsche Bundesbank. If the insured person proves by means of a bank receipt that they purchased the foreign currency at a higher price, this rate shall apply.

The costs will be paid to the insured person. They must transfer the money to the doctor or hospital by the deadline indicated on the bill.

You will receive your contract documents within 5 working days.

Yes. The insurance start date may be up to one month in the past.

Generally, it is possible to switch within the MAWISTA Student Pro tariffs. However, a health check is required for a higher insurance, this means a change from MAWISTA Student Pro Classic to MAWISTA Student Pro Premium requires a health check.

MAWISTA Student Pro

Interested in other tariffs that may suit you?

The product finder will show you all the health insurance plans available to you as an international student