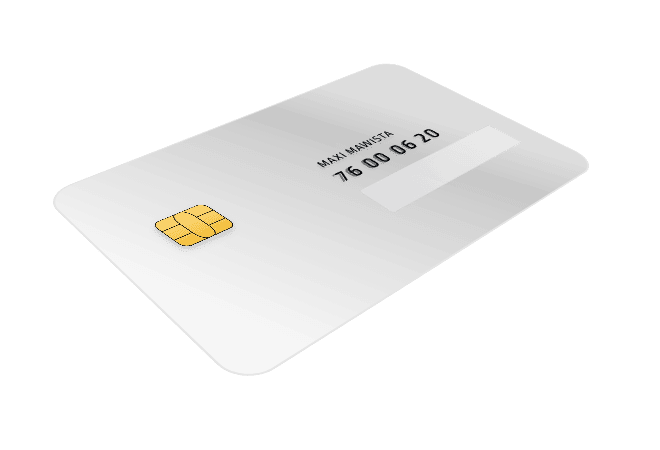

The exclusive MAWISTA insurance card

The health insurance card for your stay abroad in Germany, to conveniently identify yourself.

MAWISTA insurance card

Your advantages at a glance

Chip with relevant data

You can use the smart insurance card as a convenient proof of identity when consulting a doctor. All the relevant information required for a quick identity check is stored on the card. The manual entry of your data is no longer required and potential error sources are minimised.

Easy authentication at the doctor

The card allows you to quickly identify yourself at the doctor’s office. It is no longer necessary to enter your data and possible errors are reduced.

Emergency phone number at a glance

In the event of inpatient or extensive outpatient treatment, immediate cost coverage by the insurer may be essential. For the appropriate organization in an emergency, a team is available to you 24/7, 365 days a year. So we can help you quickly and competently.

How to get the insurance card

You receive the insurance card free of charge when you take out our tariffs Student Classic Plus, Student Comfort as well as Expatcare Comfort and Expatcare Premium for Germany.

Please note: Persons from Germany who take out a tariff for their stay abroad will not receive an insurance card, as it is only valid in Germany.

- Conclude appropriate tariff

- Order insurance card via link in mail

- Receive insurance card by mail

The exclusive MAWISTA insurance card

Tariffs with insurance card

MAWISTA Student

From €34 per month

- Private travel health insurance

- Attractive cost-benefit ratio

- With accident and liability insurance

- Monthly contract termination

MAWISTA Expatcare

From €89 per month

- Private travel health insurance

- Free choice of doctors

- Attractive price-performance ratio

- Contract can be cancelled monthly

Frequently asked questions

FAQs

Every person who has taken out one of the following tariffs for Germany is entitled to an insurance card: Student Classic Plus or Comfort, Expatcare Comfort and Premium. Persons from Germany who take out a tariff for their stay abroad do not receive an insurance card, as it is only valid in Germany.

The card enables you to quickly identify yourself at a doctor or hospital in Germany. In addition, you will find the MAWISTA emergency number on your card at a glance, which you can use to initiate direct cost coverage with the insurer in the event of inpatient treatment in the hospital.

Please note that direct payment is not possible with the insurance card. You can transfer outstanding invoices yourself as usual. You then submit the invoice to the insurer for reimbursement of the insured services.

After taking out Student Classic Plus or Comfort, Expatcare Comfort and Premium for Germany, you will receive a separate email where you can order your insurance card. This will then be sent to you by post. Please sign your insurance card upon receipt in the space provided on the back. Persons from Germany who take out a tariff for their stay abroad do not receive an insurance card, as it is only valid in Germany.

After you have purchased one of our MAWISTA tariffs including an insurance card (valid for foreigners in Germany), we will send you an e-mail with a link. You can use this link to apply for your insurance card. Afterwards, the card will arrive within 4 weeks.

The insurance card is included free of charge in our tariffs Student Classic Plus, Student Comfort, Expatcare Comfort and Expatcare Premium which are taken out for Germany. Persons from Germany who take out a tariff for their stay abroad do not receive an insurance card, as it is only valid in Germany.

Please contact our customer service in case of a lost card. We will send you an email where you can obtain a new card.

Only relevant data that the doctor needs for billing is stored on the card. This includes, for example, your name, address, date of birth, your contact details and your insurance number.

No medical data, diagnoses or other private data are stored on your card.

You can also go to the doctor before you have the insurance card. You have to give them your contact information and your insurance number. After that you will receive an invoice and submit it to the insurer.

We will process your bill within two weeks and transfer all insured treatment costs to your account. This is also the case if you do not have your insurance card with you.