Minerva

On this page you will find all information about the offered insurance package for Minerva fellowship holders. The tariffs are offered exclusively for the fellowship holders of the Minerva Stiftung.

Who can be insured?

The following persons may insure themselves within the scope of this insurance offer:

- Israeli Minerva fellowship holders, temporarily residing in Germany

- German Minerva fellowship holders, temporarily residing in Israel

- accompanying family members (partners married and unmarried, as well as children – each without own income) can also choose any of the insurance products

Foreign fellowship holders who exercise their fellowship exclusively abroad, cannot be insured with this insurance offer. All proposed tariffs provide a perpetual worldwide cover (also USA, without limitation or additional premium).

If you have been in the host country for a while, please contact the contact persons listed below to discuss the terms and conditions of admission.

Registration outside of 6 weeks after entry: Exclusion of pre-existing conditions

Registration within 6 weeks after entry: Pre-existing conditions are included

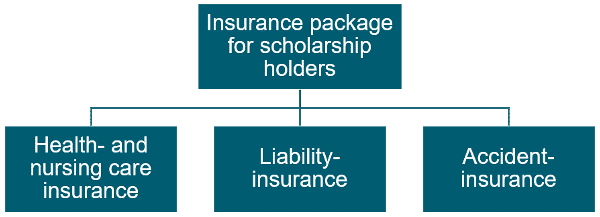

Contents of the insurance package

The insurance package for fellowship holders of the Minerva Stiftung consists of three insurance components. You can combine the insurance cover individually according to your personal needs with a health- and nursing care insurance, liability insurance and an accident insurance.

In Germany the liability and the accident insurance are optional insurances. Health and nursing care insurance is required by everyone in Germany due to compulsory insurance.

Your contacts:

For any questions specifically about the insurance package for fellowship holders, our German / English speaking team could be contacted at any time:

Phone:

+49 7024 46951 – 0

E-mail:

info@mawista.com

Beginning, end and payment for the insurance package / tariffs

Application: The insurance package can also be applied for before you enter Germany.

Beginning: You can start at every day of the month (not earlier than the date of your entry to Germany) with the respective insurance.

The technical commencement is always the first of a month.

For the health and nursing-care insurance applies:

1. Commencement with application to the end of the month following the entry to Germany.

If the application has been received (reception with the insurer) to the end of the month following the entry to Germany, the material commencement of the insurance coverage generally is the date of entry.

A commencement for the future is only possible up to 3 months after the entry, if another insurance coverage can be proven. In case of material commencement dates up to the 15th of a month the premium for the total month is to be paid.

In case of material commencement dates after the 15th of a month no premium has to be paid. The payment of the premiums then begins with the following month. This rule does not apply to the compulsory nursing care insurance (tariff PVN). For this coverage the commencement date always is the first of the following month and the premium has to be paid.

2. Commencement with application after the end of the following month following the entry to Germany.

Commencement with application after the end of the following month following the entry to Germany if the application is received with the insurer after the end of the following month of entry to Germany, the earliest material commencement of coverage is the date of entry of the application with the insurer.

In case of material commencement dates up to the 15th of the month the premium for the total month is to be paid. In case of material commencement dates after the 15th of the month no premium has to be paid.

The payment of the premiums then begins with the following month. This rule does not apply to the compulsory nursing care insurance (tariff PVN).

For this coverage the commencement date always is the first of the following month and the premium has to be paid.

Note: Registration outside of 6 weeks after entry: Exclusion of pre-existing conditions.

For the accident and liability insurance: Regardless of the beginning and the end of the insurance during the month, the whole month is payable.

End: The insurance ends technically at the end of the month of the cancellation date stated in the cancellation. The insurance cover ends at the time stated in the cancellation.

The contribution is payable until the end of the termination month.

Payment: For all tariffs in this insurance package, the premiums will be debited monthly with direct debit from a €-SEPA bank account. (EU-IBAN)

Information about the types of insurance

In which case, what insurance is useful, refer to the following short overview:

Health- and nursing care insurance

Due to the compulsory insurance in Germany, everyone needs a private or public health insurance.

Since fellowship holders cannot access the public health insurance, there is only the way to a private health insurance.

The benefits include outpatient, inpatient and dental treatment.

Nursing care insurance is a compulsory insurance and is always applied for with the health insurance for stays in Germany.

Liability insurance

Accident insurance

Brief overview about the benefits of the health insurance*

- 100% outpatient, medical treatment and psychotherapy

- 100% for medicine and dressings

- 100% for preventive medical check-up according to programs implemented by law in Germany visual aids, up to EUR 260 (every 2 years)

- 100% for dental treatment 80% for dental prostheses up to EUR 1,025 per year (tariff ELW up to EUR 750)

- 100% for inpatient treatment in a two- or multi-bed room, including private medical treatment

- 100% for pregnancy and delivery

- 100% reimbursement on repatriation transportation

- Valid worldwide

Brief overview about the benefits of the liability insurance*

- 3 Mio € Lump-sum coverage for personal injury, property damage and financial losses

- Damage to rented property up to EUR 500.000

Brief overview about the benefits of the accident insurance*

- EUR 100.000 Insured amount on full disability

- EUR 20.000 Death benefit in the event of accidental death

* The insurance conditions of the respective tariffs are legally binding.

Contribution table

In the following table you can find the monthly premiums per person according to the respective type of insurance. The premium for health and nursing care insurance depends on the age at entry, which is calculated from the current year minus your year of birth. If desired, the liability and/or accident insurance can be added to the insurance package for further EUR 6.00 per month.

Premiums valid from 01.05.2023 for other age groups: contribution table

Registration / Application for insurance(s)

Process of registration:

1.) After you chose the suitable coverage, you can apply over the below linked online-application.

2.) You will receive the insurance confirmation for the foreign office / visa authority in general on the same working day during our business hours by e-mail.

Tip

It is also possible to apply for the insurance from abroad. If you don´t have a bank account yet, you can send us the bank account details after arrival with the following form:

For fellowship holders from Israel in Germany: Please apply for the tariff BD2 as health insurance and the tariff PVN as nursing care insurance.

For fellowship holders from Germany in Israel: Please apply for the combined tariff ELW and the tariff EWB (for private medical treatment in Germany during temporary stays in Germany)

Health- and nursing care insurance

Accident insurance & Liability insurance

For each person a separate application is needed.

Online Application Accident insurance & Liability insurance

Apply direct online and get the documents direct by e-mail.

Note the registration deadlines:

Registration within 6 weeks after entry: Inclusion of pre-existing conditions Registration outside of 6 weeks after entry: Exclusion of pre-existing conditions

Please complete the application form with the PDF document and send it well scanned by e-mail to info@mawista.com or in original to:

MAWISTA GmbH

Esslinger Str. 83

73207 Plochingen

Submit bills / Report damage

Health insurance

Submit bills directly online:

Billing-App with picture function for all bills and recipes

In case of an emergency abroad or a necessary repatriation it is always recommended for the health insurance to call the following service number:

Foreign Emergency telephone number:

+49 (0)711/6603-3930

Cancellation of the insurance(s)

The termination of the insurance(s) could be done with the following letter (by Fax to +49(0)7024-4695120 or well scanned by email to info@mawista.com):Cancellation (PDF 29 KB)

Insurance terms and conditions and relevant documents

Health insurance

Tariff BD2 General Insurance Conditions:

(from page 12)

Tariff BD2 Terms- and Conditions:

(from page 7)

Tariff ELW & EWB General Insurance Conditions:

(from page 14)

Tariff ELW Terms- and Conditions:

(from page 6)

Tariff EWB Terms- and Conditions:

(from page 3)

Tariff PVN – Compulsory Care Insurance Terms- and Conditions:

(german)

Liability insurance

Insurance Terms- and Conditions:

(PDF)

Accident insurance

Insurance Terms- and Conditions:

(PDF)

Your partners at a glance

Insurance for fellowship holders

Many years of experience in advising students and fellowship holders.

Health and nursing care insurance

80-years of experience as private health insurance 622.000 insured persons

Accident and liability insurance

Many years of experience in insurance for travel, leisure and abroad.